Finance

From the Series: The Infrastructure Toolbox

From the Series: The Infrastructure Toolbox

Less a tool in a toolbox than a placeholder for a needed tool, this essay asks after the relationship between infrastructure, finance, and economic growth. We want to suggest ethnographic attention to the financial relationships that subtend any major infrastructure project—attention to the places where critical theories of finance meet the built environment, where the burgeoning interest in debt scales up to municipalities, states, and sovereigns, and where the Anthropocene meets liberal ideals of economic growth and provisioned citizenship.

India’s national electrical grid boasts the third-largest installed electrical capacity in the world. In July of 2012, three of the nation’s five regional grids failed, leaving over six hundred million people in the dark for two days. This event has been acknowledged as the largest blackout in world history, affecting a country where, of course, more than three hundred million people do not have regular access to electricity, blackout or not. Financial analysts in London and New York argued that the blackout would have a “credit negative” effect on India’s economy, which had been struggling with falling growth rates, inflation, coal shortages and climate change‑related drought. Post-blackout, Indian energy infrastructure was perceived as a riskier asset class in international capital markets. Such credit effects raise the cost of borrowing for infrastructure and can deter foreign investment. How, we might ask, did India’s electrical grid (POWERGRID) and its principal source of energy (COALINDIA) come to be publicly traded on the Bombay Stock Exchange? How are the grid and its vast archipelago of public-private partnerships rendered financial assets in global markets, and to what effect?

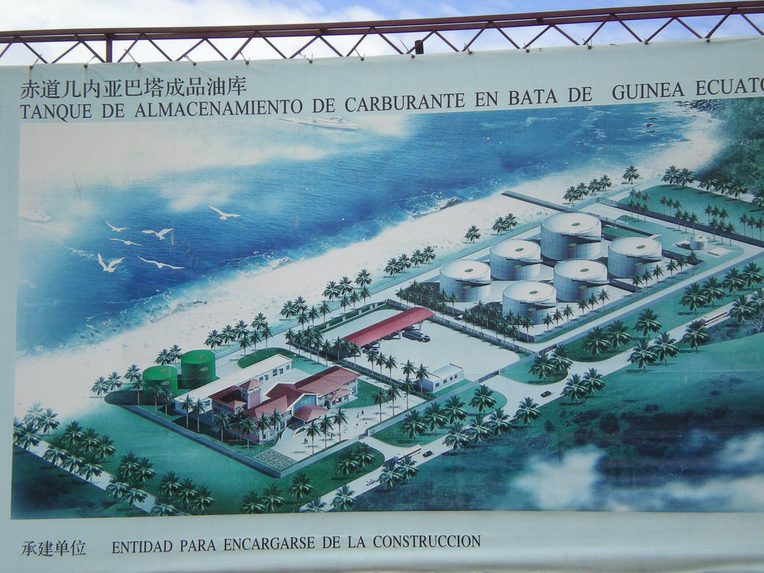

In 2013, oil-rich Equatorial Guinea saw more investment as a percentage of GDP (61.3%) than any other country in the world. Investment as a percentage of GDP is the statistical reflection of infrastructure at the national level, accounting for investment in roads, railways, electric and water grids, schools, hospitals, commercial and industrial buildings. That Equatorial Guinea had the world’s highest percentage reflects the extraordinary intensity of infrastructure development there, an intensity that is visceral, sensory—the vibration of jackhammers, bulldozers, and trucks too big for colonial roads or cement dust that settles on skin and in mouths. Construction sites buzz with day laborers—often immigrants from Senegal, Cameroon, or Benin—welding, swinging metal beams, and digging ditches into the colonial undercity. More workers from Moroccan, Chinese, and Egyptian parastatal companies pave roads and build bridges, dams, airports, ports, stadia, and governmental palaces. Equatorial Guinea is one of only a handful of countries, including China, that is able to pay outright for infrastructure projects, a process that often includes inflated contracts with parastatals from sympathetic regimes (like China), the excess from which is kicked back to Equatoguinean officials. Globally, Africa is perceived as a growing market for infrastructure finance, an evaluation pegged to economic growth rates. What epistemologies and politics are involved in the relationship between infrastructure, petrodollars, economic growth, and south-south finance?

California, 2014: Proposition 1 sought voter approval for $7.12 billion in general-obligation bonds for water infrastructure, including surface and groundwater storage, water recycling, advanced treatment technologies, and flood control. Having been approved by the voters, the bonds will be repaid with interest over forty years by general tax revenues. Union pension funds are major investors in this kind of bond offering, and yet as the labor on these infrastructure projects, unionized workers are also a cost. Making a deal like this financially feasible often entails pressure to reduce workers’ health and retirement benefits or to downsize the workforce. How is it that California’s unions are simultaneously agents and objects of infrastructure finance? At the intersection of bond offerings, pension funds, and labor, what kinds of liberal citizenship are hailed by California’s infrastructure, as compared to that of India or Equatorial Guinea?

Electricity in India. Water in California. Infrastructural phantasmagoria in Equatorial Guinea. And different forms of finance in each: debt relations, public-private partnerships, state-supplied petrodollars, and taxation half a century into the future. How are classic questions of value, risk, distribution, and personhood reconfigured in infrastructure finance deals? One example: when infrastructure is understood as an asset class, bridges, grids, trains, or pipes themselves are not the source of value, nor are the services they render. Rather, value is the potential revenue that flows from bridge tolls, electricity tariffs, or water prices, not only to private investors but also to the state as a kind of privatized investor. Likewise, the feasibility study for any infrastructure project calculates perceived risk, thus mobilizing particular imaginaries of India, Africa, and California that are bound up with assessments of political stability, demographic makeup, cost of labor, and the prevalence of corruption. A leading textbook taught in law and business schools around the world (Esty 2004) takes stock of political and cultural risks in the Chad-Cameroon petroleum pipeline, Kuwaiti petrochemical plants, the Australia-Japan submarine telecommunications cable, high-speed rail in Texas, Vietnamese sugar factories, and Hong Kong’s Disneyland, among others. Instructional texts like this provide a kind of optical reversal of globalization curricula in the social sciences and humanities.

Beyond the scale of individual projects, infrastructure finance is linked to epistemologies of economic growth, a linkage it shares with history in the mutual constitution of liberalism and empire. John Maynard Keynes, who wrote his first book (Keynes 1913) while working for the East India Company, famously argued that economic stimulus is best achieved by lowering interest rates and encouraging government investment in infrastructure. After 2008, Keynesian advocacy for infrastructure investment as stimulus experienced a revival, as everyone from the World Bank to the consulting firm McKinsey to participants in Occupy Wall Street called for renewed infrastructure investment in both the global north and south. Anthropology, geography, and neighboring intellectual endeavors have also turned to infrastructure, an analytical turn that Dominic Boyer (2013) suggests could be viewed as “a conceptual New Deal for the human sciences—a return of the repressed concerns of public developmentalism.” And yet, both Boyer and Timothy Mitchell (2011) caution that Keynesian nostalgia for postwar modernity does not offer us a way forward, insofar as it was predicated on fantasies of endless growth fueled by imperial control of oil in the Middle East and beyond. Whither Keynes in the Anthropocene?

As U.S. states like California, Vermont, and Washington begin serious considerations of public banks, what other kinds of financial imaginaries might become possible? How might practices of south-south finance—and the distinct political and cultural notions of value, risk, and growth they might generate—reconfigure notions of liberalism and empire? Do south-south infrastructure finance projects produce liberal notions of propertied citizenship and personhood? Do they produce something else? As Coal India acquires mines in Mozambique and Chinese and Egyptian parastatals vie for contracts in Equatorial Guinea, what other sociofinancial relationships will develop and to what effect? How might rethinking infrastructure finance help us to rethink economic growth itself?

Boyer, Dominic. 2013. Discussant comments for “The Anthropology of Infrastructure” session at the Annual Meeting of the American Anthropological Association, Chicago, November 23.

Esty, Benjamin C. 2004. Modern Project Finance: A Casebook. New York: Wiley.

Keynes, John Maynard. 1913. Indian Currency and Finance. London: Macmillan.

Mitchell, Timothy. 2011. Carbon Democracy: Political Power in the Age of Oil. New York: Verso.